The Company

Low online sales conversion rates. Inefficient customer service. These are the problems FlamingoAI is solving with its game-changing technology. With our training data powering its virtual-assistant platforms, the machine learning company now creates better online experiences for its financial and insurance-industry clients—and their customers.

“With our platform, consumers get to have these conversations in natural language.”

–Dr. Jack Elliott FlamingoAI

Chief Data Scientist

The Challenge

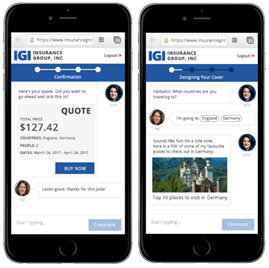

FlamingoAI specializes in “conversational commerce” technology for enterprises. The company’s artificial intelligence-based virtual assistant platforms help financial services and insurance companies automate online customer experiences for higher satisfaction scores, better sales conversion rates, and lower costs.

With offices in New York and Sydney, FlamingoAI has seamlessly combined instant messaging, smart workflow, natural language processing, and machine learning to automatically serve customers online, guiding them through a chat-based sales process or service experience. “With our platform,” says chief data scientist Dr. Jack Elliott, “consumers get to have these conversations in natural language. In turn, we learn from those conversations and automate them, ensuring that our assistants keep getting better at helping customers find and get what they need.”

FlamingoAI needed a way to train new deployments of its virtual assistants so they’d be ready to work independently their first day at a new job. Or as Elliott says, a way “to solve the cold-start problem.”

In a typical scenario, FlamingoAI initially sets up one of its virtual assistants as a “co-pilot” alongside a human operator. As that operator interacts with customers and answers questions, the platform tracks each exchange and starts to learn by recognizing patterns. After a few weeks of this training phase, the virtual assistant will be ready to strike out on her own and operate independently.

However, some clients want to improve their customer experiences and conversion rates faster. They can’t afford to wait. “A lot of our clients are really excited about automation,” says Elliott. “They want to quickly get to the point where the machine is completely autonomous—skipping the training phase altogether and being fully automated from day one. That’s why we started working with Appen.”

The Solution

How well the virtual assistants perform right out of the gate in these “cold start” situations depends on their training. They need to learn the ropes by fielding the same kind of natural language questions that customers would ask. To get those questions, FlamingoAI turned to us based on our reputation for delivering high-quality training data to leading technology firms around the world.

Our first project for FlamingoAI was a project just like this for an Australian Stock Exchange (ASX) 100 Australian financial services firm. We sourced a group of native Australian-English speakers, and asked them to provide questions, comments or responses based on a specific step in a customer journey or process such as applying for superannuation. The questions we provided stood in for the real-world data FlamingoAI didn’t have time to collect, and when fed to the virtual assistant, successfully prepared her for the interactions she had once she went live on the customer’s website. As a result, the end customers’ experiences were greatly improved by interacting with the virtual assistant instead of using a static web form.

FlamingoAI also deployed its virtual assistant fully automated from day one, and pre-trained on data we provided, at a US-based Fortune 100 client. After just seven weeks, the virtual assistant was responding to over 80% of all customer questions and was converting life insurance quotations at about a 30% success rate.

One customer using the platform said, “I liked the personal touch. And it was quick. I prefer it to speaking over the phone. This is much more convenient. Another said, “This is a new way of answering questions and helping understand the insurance world… different from any other company. It was a great experience!”

With data collection efforts like this one, it’s critical to get the right data: as close as possible to what real customers would ask when interacting with the system. That’s why our account managers work closely with clients to create exacting specifications at the outset, as well as throughout a project to ensure the highest quality. “The client account manager has been an absolutely vital connection for us,” says Elliott. “Whenever you specify things, there are going to be areas of ambiguity, or things that are hard to define, that aren’t 100 percent complete or correct. The great thing about Appen is that as soon as they have a batch of data, they come to us and say ‘Here’s our first data delivery, does this meet your needs?’ We work together to fine-tune it, and then they repeat the process, gathering more data and bringing it back to us, until we get it right.”

FlamingoAI CEO Dr. Catriona Wallace agrees. “The Appen team was a joy to work with,” she says. “They demonstrated clear expertise in developing our training data and delivered it ahead of schedule and under budget. Collaborating with Appen ensures that our virtual assistants can deliver on the value proposition of improved customer service and accelerated sales for our clients from day one.”

The Result

FlamingoAI successfully solved the cold-start problem, deploying completely autonomous virtual assistants that worked from the outset without any human training.

For this reason, FlamingoAI has found that the benefit of working with us goes beyond simple money or time savings. “It’s an all-out capability thing,” says Elliott. “You can’t be a machine learning firm that develops core IP and also sources key data the way Appen does. Ultimately, you have to specialize in one or the other. Appen gives us the ability to focus on our business, while they take care of the data sourcing.”